Regardless of your level of affluence, studies show that you need to know what you want out of life before you can achieve it. So states the wisdom of Lee Eisenberg in his bestseller, The Number: A Completely Different Way to View the Rest of Your Life.[I]

Eisenberg’s number refers to that amount of savings a person or couple must accumulate to enjoy a “secure” post-career lifestyle. His “completely different view” is based on the premise that the clearer your goals, the more likely they can be achieved. Establishing a precise goal, analogous to business planning, can be the best assurance of its attainment.

In practice, “Your Number” is typically not a single number but rather a series of numbers. Knowing the important role this kind of objective clarity can provide to our clients, we have spent considerable effort to develop this capability. Our version is a process capable of helping clients objectively understand their trade-offs so they can make more informed decisions.

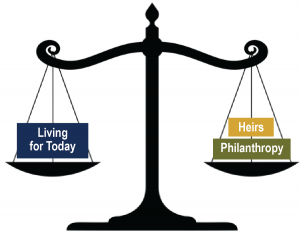

For those still saving, as well as for those near or in retirement, clients often grapple with covering their own financial needs versus how much to leave for their heirs and/or charity. Many have found that by having “Your Number,” they are better able to address these issues once they know the estimated cost of supporting their lifestyle. With what remains, they can more confidently decide how much can go to philanthropy and heirs, and whether that happens during their lifetime or after they pass.

Lifestyle Goals Feasibility: Determining the feasibility of your lifestyle goals is an important starting point. Certainly if overly ambitious, the low probability of attaining those goals may render other goals inconsequential. Our process involves providing an average, annual after-tax return (ROR) needed for the lifestyle goal’s attainment. That ROR can then be compared to historic returns of different asset classes to determine the associated risk involved.

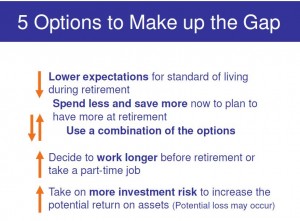

For example, if to achieve their lifestyle goals the study calculates that a 10 percent average ROR is needed, that figure compared to historical returns, may suggest a more aggressive portfolio heavily weighted in growth stocks. A specific, meaningful discussion can then ensue wherein the clients can consider how comfortable they may be with that level of risk. If not, to bridge the “gap” they can consider options that may include reducing current spending, increasing savings, postponing retirement age, or some combination. Whatever they decide, they are able to feel more in control to do so based on objective feedback that can make these oft times nebulous conversations, much more tangible.

“How am I Doing?” is likely the most common question clients have asked over my 35+ years as an advisor. The “Your Number” process helps address this question by projecting the value a portfolio needs to attain each year to assure we are on track. For example, a couple may have a $133,000/yr. retirement income goal when the husband reaches his desired retirement in five year’s time. To generate that, they may need nearly $2 million. Their “Your Number” study may suggest they will need $1,827,515 in three years to show they are on track to their retirement income goal. We are able to compare their then- prevailing balance to that figure, to readily gauge our progress and, hopefully, ease their concern.

“Am I Running Out of Money?” Concern over spending too much and not having enough later in retirement is another common concern. Again, the “Your Number” process gives us annual benchmarks from which clients can easily determine where they stand and if they may be spending too much, or perhaps not spending all that they could. Similarly, at ten years into retirement, the same client’s plan will show a $1,869,340 balance is needed to help assure they will not run deplete funds prematurely. Comparing that to their then-current balance can quickly help them determine where they stand. This capability gives clients a greater sense of confidence and control over their futures.

Benefiting from Greater Clarity as We Age: The clarity provided by this approach may prove consistent with the normal aging process. “As people mature, their cognitive patterns become less abstract and more concrete…,” according to psychologist David Wolfe.[ii] Research attributes this to a normal shift from left to right brain orientation during the aging process. The result is a sharpened sense of reality, increased capacity for emotion and an enhanced sense of connectedness.

The left hemisphere helps us with rational functions such as logic and organized, quantitative processes. The right hemisphere is the intuitive side that gives us creativity and analogic reasoning. Theory suggests that many of us may be slightly dominant in one side or the other, which may lend insight into how best we learn. “In other words… ,” as Daniel Pink notes in his recent book, A Whole New Mind, “… as individuals age they place greater emphasis in their own lives on qualities they might have neglected in the rush to build careers and raise families; purpose, intrinsic satisfaction and meaning.”[iii] It makes intuitive sense that as we age and face our own mortality, we would become more sensitized to higher level emotional issues. That there might be a neurological or bio-chemical reason for this seems intriguing. Evidence of this trend may be found in the fact that over 10 million U.S. adults now engage in some form of regular meditation, double the number in 2005. Further, about 15 million people currently practice yoga, twice that in 1999.

While greater specificity is needed around the quest for money, Eisenberg cautions that we need to know ourselves and spend some time determining what makes us happy before we can make informed plans for leaving the world of active income. What do you want your retirement to be? Who do you want to be in retirement? Eisenberg’s research shows that even the affluent tend to procrastinate on addressing these issues.

Thus it would seem that, when tackling the three main questions we each must address—What will my retirement look like? When can my retirement plan happen? How much will it cost?—the traditional financial services approach makes a fundamental error in attempting to address the last question first. Eisenberg muses that we need to know what we need the money for before we can estimate how much. Hence the rise of various types of “life coaches” to help us wrestle with these more elusive issues.

The bottom line of the “Your Number” process is that, regardless of your state in life, better planning can often help both from an aesthetic and practical standpoint. As Eisenberg notes, “An unexamined life may or may not be worth living, but it is certainly more expensive.”

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Wells Fargo Advisors Financial Network LLC (WFAFN) does not provide tax or legal advice. We strongly recommend an advanced tax and estate planning expert be contacted for further information. Any opinions are those of Mitchell Kauffman and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but Wells Fargo Advisors Financial Network does not guarantee that the foregoing material is accurate or complete. Prior to making a financial decision, please consult with your financial advisor about your individual situation.

Mitchell Kauffman provides wealth management services to corporate executives, business owners, professionals, independent women, and the affluent. He is one of only five financial advisors from across the U.S. named to Research magazine’s prestigious Advisor Hall of Fame in 2010, and among a select list of 100 over the past 20 years.

Inductees into the Advisor Hall of Fame have passed a rigorous screening, served a minimum of 15 years in the industry, acquired substantial assets under management, demonstrate superior client service, and have earned recognition from their peers and the broader community.

Kauffman’s articles have appeared in national publications, and he is often quoted in the media. He is an Instructor of Financial Planning and Investment Management at the University of California at Santa Barbara.

For more information, visit www.kwmwealthadvisory.com or call (866) 467-8981. Investment products and services are offered through Wells Fargo Advisors Financial Network LLC (WFAFN), Member SIPC. KWM Wealth Advisory is a separate entity from WFAFN.

[i] The Number: A Completely Different Way to Think About the Rest of Your Life, by Lee Eisenberg Free Press 2006

[i] A Whole New Mind, by Daniel Pink Riverhead Books 2006 Pg. 60

[i] A Whole New Mind, by Daniel Pink Riverhead Books 2006